Companies Commission of Malaysia (“CCM”) has issued the Guideline for the Reporting Framework for Beneficial Ownership of Legal Persons which take effect on 1 March 2020. The guideline is applicable to all legal persons such as companies (local and foreign companies), limited liability partnerships (local and foreign limited liability partnerships) and business (sole proprietors and partnerships).

Beneficial owners (“BO”) are always natural persons who ultimately own or control a legal entity or arrangement. The Companies Act 2016 (“CA 2016”) defines BO as “the ultimate owner of the shares and does not include a nominee of any description”. This definition must be read together with concept of “interests in shares” under section 8 of the CA 2016.

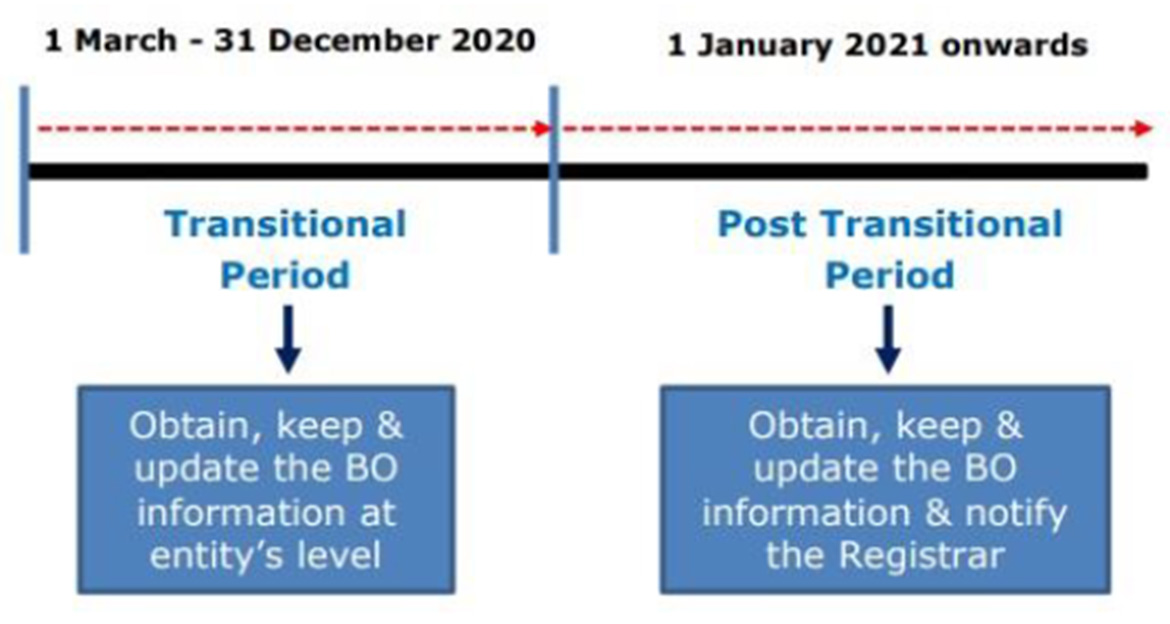

- Timeline of Obligation

The timeline of the obligation for companies and limited liability partnerships relating to obtaining and keeping the BO information accurate and up-to-date are as follows:

- BO reporting framework

The BO reporting framework comprises of seven (7) steps and is set out in the guidance notes issued by CCM.

- Roles and Responsibilities in the case of a company

Board of directors The board of directors is ultimately responsible in ensuring that the company has exercised its powers under subsection 56(1), (2) or (3) of the CA 2016 in obtaining the BO information. The obligation also extends to ensure that once such BO information is received, the information must be entered into a separate part of the register of members [register of members as stated under subsections 51(1) and 56(4)]. Members of the company If a member of a company has received a notice issued under subsection 56(1) or (3) of the CA 2016, the member has an obligation to inform the company whether he is the BO as defined by the CA 2016 or has met at least one of the criteria stated under paragraph 27 of the guideline, as a trustee or that the voting rights held by him is subject to an agreement or arrangement in which another person is entitled to exercise that voting rights. The obligations of a member under these subsections also extend to the need to provide the particulars of the persons for whom the member holds the voting shares or the parties to the agreements or arrangements, as the case may be, to the extent that such other persons can be identified. A person who fails to comply with a notice issued under section 56 or has provided a false information or has made a statement recklessly commits an offence as stated under subsection 56(7). Any other person who has been given notice under subsection 56(2) If a person who is not a member of a company receives a notice from the company under subsection 56(2) of the CA 2016, the person has the obligation to inform the company whether he is the BO of the company as defined under the CA 2016 or has met at least one of the criteria stated under paragraph 27 of the guideline or as trustee. Similar to a member of the company, the obligations of such person also extend to the need to provide the particulars of the persons for whom the person holds the voting shares in his capacity as trustee to the extent that such other persons can be identified. A person who fails to comply with the notice issued under section 56 or has provided a false information or has made a statement recklessly commits an offence as stated under subsection 56(7). Company Secretary/Agent In line with the duty of a secretary under subsection 102(1) of the CA 2016 to properly keep and regularly maintain the register of members, the secretary must ensure that the BO information is entered into in accordance with the requirement set out under subsection 56(4). In addition, a secretary is also responsible to lodge the BO information to the Registrar in accordance with the provisions under subsection 56(6) or 51. - Definition of Beneficial Ownership

Company limited by shares Company limited by guarantee (“CLBG”) An individual is deemed to be a beneficial owner or have control over a company if one or more of the criteria below was satisfied: An individual is deemed to be a beneficial owner or have control over the CLBG if one or more of the criteria below was satisfied: - Has interest, directly or indirectly, of notless than 20% of the shares of the company.

- Holds, directly or indirectly, not less than20% of the voting shares of the company.

- Has the right to exercise ultimate effectivecontrol whether formal or informal over thecompany, or the directors or themanagement of the company.

- Has the right or power to directly orindirectly appoint or remove a director(s)who holds a majority of the voting rights atthe meeting of directors.

- Is a member of the company and, under anagreement with another member of thecompany, controls alone or through thecumulative effect of the agreement amajority of the voting rights in thecompany.

- Has the right to exercise ultimateeffective control, whether formal orinformal, over the company, thedirectors or the management of thecompany.

- Has the right or power to directly orindirectly appoint or remove a director.

- Has the right to exercise, or actuallyexercises ultimate effective controlover the company.

- Exempted entities

The following companies are exempted from the BO report framework:

- Companies which are licensed by Bank Negara Malaysia under the Financial Services Act2013 [Act 758], Islamic Financial Services Act 2013 [Act 759], a prescribed developmentfinancial institution under the Development Financial Institutions Act 2002 [Act 618] or alicensed Guideline for the Reporting Framework for Beneficial Ownership of Legal Persons15 money services business under the Money Services Business Act 2011 [Act 731];

- Persons regulated under the securities laws as follows:

- Entity licensed or registered under the Capital Markets and Services Act 2007 [Act671](CMSA 2007);

- Stock exchange, derivatives exchange, clearing house and central depositoryapproved under the securities laws;

- Recognised self-regulatory organisation (SRO) under the CMSA 2007; and

- Private retirement scheme administrator approved under the CMSA 2007;

- Companies whose shares are quoted in a stock exchange, either local or foreign exchange;

- Companies whose shares are deposited in the central depository pursuant to the SecuritiesIndustry (Central Depositories) Act 1991 [Act 453]. The exemption under this subparagraph(d)only applicable if all the shares in a company remain deposited with the centraldepository.

For more detail, please click here