Companies Commission of Malaysia (“CCM”) has on 28 November 2019 circulated an article to Director and Secretary in relation to the Important of Audit Opinion in Auditor’s Statement.

The Directors of the Company are responsible for the preparation of financial statements that give a true and fair view of the financial position as at the end of the financial year and the financial performance for the financial year of the company in accordance with the Companies Act, 2016.

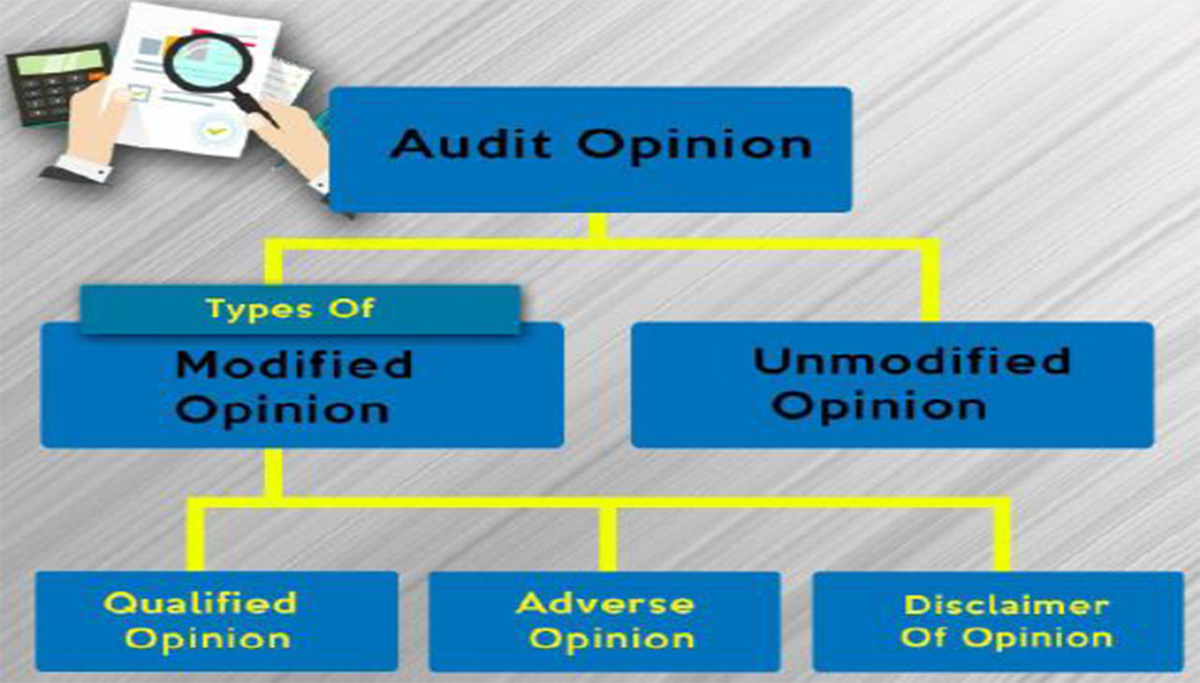

The opinion paragraph is to state the auditor’s conclusions based upon the results and the audit evidence. The most important information in the opinion paragraph includes the words “in our opinion” which indicate that the conclusions are based on professional judgement and about whether the financial statements were presented fairly and accordance with Malaysia Accounting Standard Board (MASB) Approved Accounting Standard and the Companies Act, 2016.

- Qualified Opinion

The auditor shall express a qualified opinion when:

- The auditor, having obtained sufficient appropriate audit evidence, concludes thatmisstatements, individually or in the aggregate, are material, but not pervasive, to thefinancial statements; or

- The auditor is unable to obtain sufficient appropriate audit evidence on which to base theopinion, but the auditor concludes that the possible effects on the financial statements ofundetected misstatements, if any, could be material but not pervasive.

- Adverse Opinion

The auditor shall express an adverse opinion when the auditor, having obtained sufficient appropriate audit evidence, concludes that misstatements, individually or in the aggregate, are both material and pervasive to the financial statements.

- Disclaimer of Opinion

The auditor shall disclaim an opinion when the auditor is unable to obtain sufficient appropriate audit evidence on which to base the opinion, and the auditor concludes that the possible effects on the financial statements of undetected misstatements, if any, could be both material and pervasive.